Der IFRS-Expertenlehrgang ist zur allgemeinen Weiterbildung im im Bereich der IFRS absolut zu empfehlen. Durch den praxisnahen online Bereich und die gute Präsensschulung wird ein erstklassiger Bezug zwischen theoretischen Grundlagen und praktischer Anwendung hergestellt.Manuel, Kunde IFRS-Expertenlehrgang, www.fernstudiumcheck.de

Demo-course Financial statement according to HGB

Rapid processing

Secure payment

256 bit encryption

Financial statements according to HGB

From the bookkeeping to the annual financial statements according to HGB

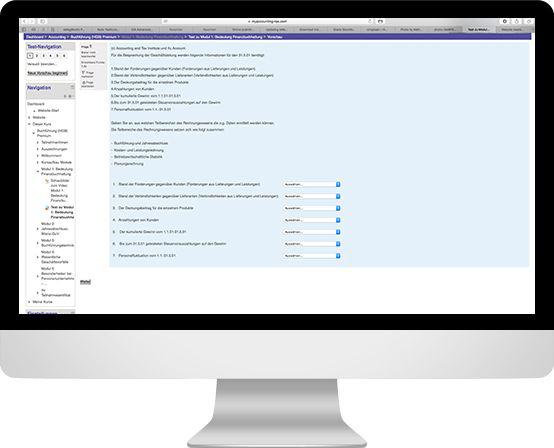

Do you already have knowledge of preparing annual financial statements in accordance with the German Commercial Code and would you like to test your knowledge on the basis of case tasks? Then this course is the right place for you. We provide 100 case tasks. We work with the individual case tasks, the balance sheet items in accordance with § 266 HGB and the expense and income items in accordance with § 275 HGB and also check wether you master the profit, equity and cash effects of the individual closing entries. The case tasks simulate tests. After submitting the tests, you will receive detailed solutions that not only show the solution but also convey background knowledge. With our concept you can look forward to you exams with ease.

Our services

Our proven concept in numbers and facts

Webbased-trainings

Prove your know-how! Tasks based on exam level will

prepare you well for exams and practice. Get access to

103 exercises with extended illustrations.

Assistance

We support you and answer promptly.

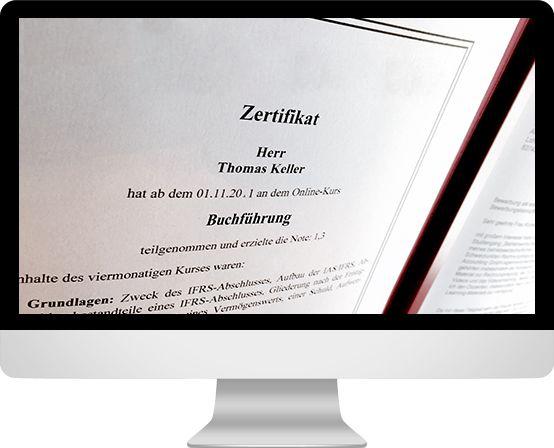

Participant certificate

In connection with your course booking you will get

significant participant certificate.

Access period

The access period compromises six month.

Webbased-trainings

The webbased-trainings are divided in units and can repeated optionally. They are based on the level of universities, respectively "Industrie- und Handelskammern". The solutions comprise illustrated explanations.

Participant certificate

A significant participant certificate is available for download.

Annual financial statements (HGB)

An overview of your course content

Unit 1: Basics

Relationship between commercial and tax annual accounts

Components of a financial statement

Sources of profit/loss in the income statement

“Profit, equity and cash impact” of different business transactions

Nature of expense method/Function of expense method

Cash flow statement

Determination of acquisition and manufacturing costs

Scheduled depreciation

Generally accepted standards of accounting

Disintegration of legal and economic property

Unit 2: Intangible assets

Recognition

Initial measurement

Subsequent measurement

Unit 3: Property plant and equipment

Initial measurement and subsequent measurement

Scheduled depreciation and impairment loss

Reversing an impairment loss

Disclosure

Unit 4: Financial instruments

Initial measurement and subsequent measurement

Impairment loss

Reversing an impairment loss

Disclosure

Unit 5: Current assets

Measurement of row material, operating supplies and auxiliaries

Cost formulas and measurement of finished and unfinished goods

Impairment loss

Measurement of receivables

Unit 6: Liabilities

Recognition and measurement of payables

Recognition and measurement of provisions

Discounting issue of provisions

Unit 7: Equity

Partnerships and Corporations: Detailed structure of equity

Unit 8: Special Accounting issues

Foreign Currency Transactions

Prepaid expenses and taxes, in particular deferred tax assets and deferred tax liabilities,

deferred tax assets in relation with tax loss carryforward

Your online course on any device

Further education everywhere and everytime

Unsere Referenzen