I completed the accounting course and was well prepared for the exam. The webbased training with detailed solution explanations helps to close the last gaps.Clare, customer bookkeeping, www.fernstudiumcheck.de

Demo-Course Bookkeeping (according to HGB)

Dieses Produkt ist nicht länger verfügbar.

Schnelle und einfache Bestellung

Sichere Zahlungmethoden

256 Bit Verschlüsselung

Bookkeeping (according to HGB)

Your perfekt start into the world of accounting

You are at the beginning of your studies or your trainings respectively qualification and you want to book business transactions correctly? You pass the exam in the subject "bookkeeping" soon? No problem, then decide do order this course. Test your knowledge with our wide case studies. They are divided in 5 units, so you can work your comprehensive check for each topic. The Webbased-Trainings comprise extended illustrations and background knowledge. So you are well prepared for coming exams. You can repeat the tests optionally and you receive a percental evaluation of your achieved results. learn independent, access to your course flexibly, to the comprehensive Accounting-Know-How, from each place, at any time.

Our services

Our proven concept in numbers and facts

Webbased-Trainings

Prove your know-how! Tasks based on Examen level will

prekäre you well from the Examens and practice. Get

access to 80 exercises with extended illustrations.

Assistance

We support you and answer promptly.

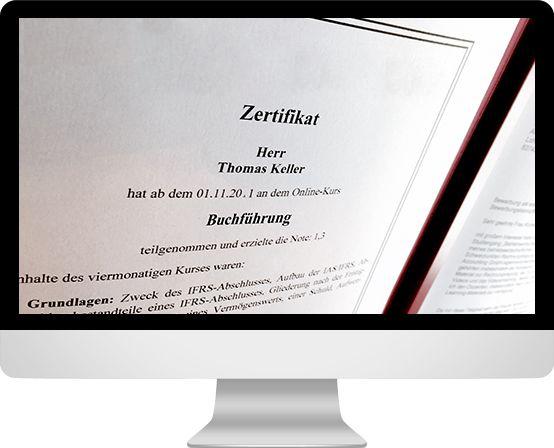

Perticipant Certificate

In connection with your course booking you will

get significant participant certificate.

Access Period

The access period compromises six month.

Webbased-Trainings

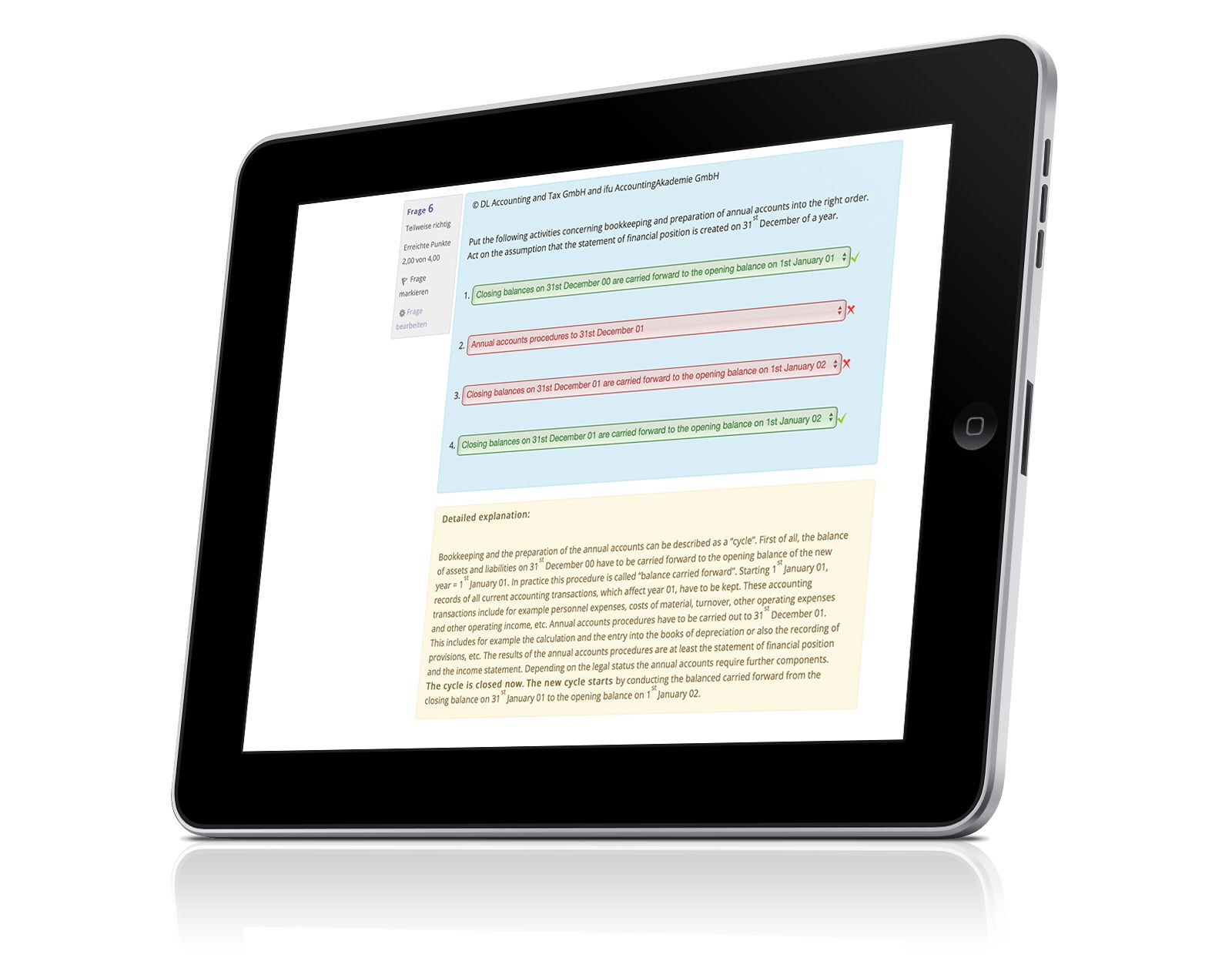

The webbased-trainings are divided in units and can repeated optionally. They based on the level of unversities, respectively "Industrie- und Handelskammern". The solutions comprise illustrated explanations.

Participant Certificate

A significant participant certificate is available for download.

Bookkeeping (according to HGB)

Your course at a glance

Meaning of financial Accounting:

Matching of financial accounting in business accounting

Tasks of financial accounting

Accounting obligation in commercial law ("HGB") respectively taxation law

Double bookkeeping against cash-flow-accounting

Bookkeeping cycle

Annual financial statement - Statement of financial position - Income statement:

Components of annual financial statements

Items statement of financial position

Items of income statement

Non current and current assets

liabilities

equity

Development of expenses and revenues (matching principle) and possible differences to cash-flow treatments.

Profit or loss

Inventory

Bookkeeping-process:

Inventory booking

Booking with effect in profit or loss

Effects on profit and loss as well as liquidity

Close accounts to prepare the annual statement

Booking of the main business transactions:

Procurement (property plant and equipment, raw equipment, raw materials and supplies, merchandise, services personnel)

Selling

Change in inventory

Other capitalized personal contribution

Withdrawals and deposits in partnerships

Withdrawals (cash, assets, service)

deposits

effects to equity accounts

Your online-course on every device

education independent of time and place

Unsere Referenzen