Ich besuche einen Fernlehrgang und muss eine Klausur im Fach "Buchführung" ablegen. Die mir in Papierform vorliegenden Materialien haben mir nicht ausgereicht. Um sicher zu gehen, habe ich den Buchführungskurs-Premium gebucht. Das Preis-Leistungsverhältnis ist einfach fantastisch. Durch professionelle Videos werden sämtliche Geschäftsvorfälle, die praxisrelevant sind, erklärt. Durch wiederholtes Aufrufen kann man sich den Stoff besser einprägen. Daneben hat man die Folien, die im Video gezeigt werdender Verfügung, um zum Beispiel Notizen zu machen. Die beste Klausurvorbereitung sind die Web- Based- Trainings. Am Ende der Durchführung erhält man eine prozentuale Auswertung der erreichten Ergebnisse.Jule, Kunde Buchführung (HGB) Premium, www.fernstudiumcheck.de

Demo-course Bookkeeping (HGB) Premium

Schnelle und einfache Bestellung

Sichere Zahlungmethoden

256 Bit Verschlüsselung

Demo-course Bookkeeping (HGB) Premium

Your perfect start into the world of accounting

Are you at the beginning of your studies or your training and further education and would like to be able to book business transactions correctly in practice? No problem, then choose this course. In this course we will teach you the ability to deal with "debit and credit" correctly. We have divided the subject into five modules so that you can work on the videos, the power point slides and the case exercises according to the topic. The webbased case tasks contain detailed solution explanations and background knowledge. You are well prepared for upcomining exams. Learn independently, flexibly access the entire "Accounting Know-How" from any place, at any time.

Our services

Our proven concept in facts and figures

Video-Training

Knowledge in a nutshell. The video-training

last 104 minutes.

PDF-Slides

Didactically prepared and clear sets of

slides, suitable for the video streams. The

slide sets have a scope of 142.

Webbased-Trainings

Test your knowledge! Get access to 80 case

exercises with detailed solution explanations.

The case exercises at exam level prepare

you optimally for the exam and practice.

Tutoring support

We support you and answer your questions

about the course promptly.

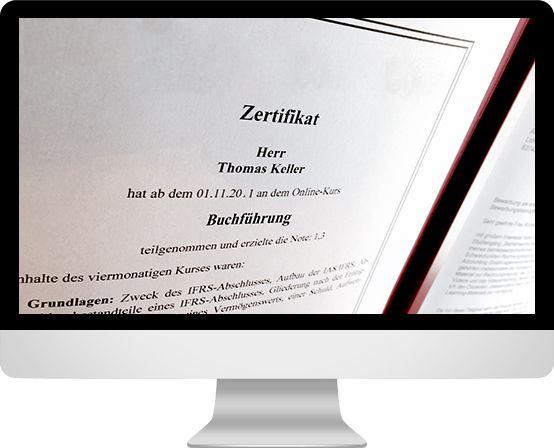

Certificate of Participation

You will receive a meaningful certificate of

participation when you book the course.

Access duration

When you book, you will receive access for

six months.

Video-Training

Modular video recordings with highly qualified speakers from the field and corresponding Power Point slides.

Webbased-Training

The case tasks have a modular structure and can be repeated as often as you like. The practice cases are based on the level of the exams of the chambers of industry and commerce as well as final exams at universities and colleges. The solutions contain detailed explanations, in particular the solution path ist shown.

Digital script

The scripts are divided into modules. The course content is available as a "pdf file" so that the content can be called up flexibly.

Certificate of participation

A meaningful certificate of participation is available for download.

Testen Sie unsere Videos

Demo-course Bookkeeping (according to HGB)

Your course at a glance

Unit 1: Meaning of Financial Accounting (only included in paid course)

Matching of financial accounting in business accounting

Tasks of financial accounting

Accounting obligation in commercial law ("HGB") respectivley taxation law

Double bookkeeping against cash-flow-accounting

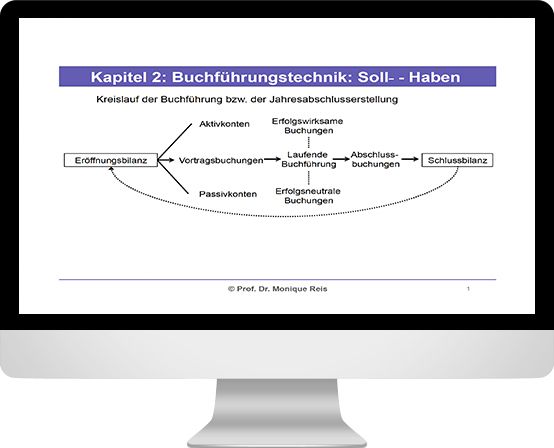

Bookkeeping cycle

Unit 2: Annual financial statement - Statement of financial position - Income statement (only included in paid course)

Components of annual financial statements

Items statement of financial position

Items of income statement

Non current and current assets

liabilities

equity

Development of expenses and revenues (matching principle) and possible differences to cash-flow treatments

Profit or loss

Inventory

Unit 3: Bookkeeping-process

Inventory booking

Booking with effect in profit or loss

Effects on profit and loss as well as liquidity

Close accounts to prepare the annual statement

Unit 4: Booking of the main business transactions (only included in paid course)

Procurement (property plant and equipment, raw equipment, raw materials and supplies, merchandise, services personnel)

Selling

Change in inventory

Other capitalized personal contribution

Unit 5: Withdrawals and deposits in partnerships (only included in paid course)

Withdrawals (cash, assets, service)

deposits

effects to equity accounts

Your Online Course on any device

Further training independent of time and place

Unsere Referenzen