Der IFRS-Expertenlehrgang ist zur allgemeinen Weiterbildung im im Bereich der IFRS absolut zu empfehlen. Durch den praxisnahen online Bereich und die gute Präsensschulung wird ein erstklassiger Bezug zwischen theoretischen Grundlagen und praktischer Anwendung hergestellt.Manuel, Kunde IFRS-Expertenlehrgang, www.fernstudiumcheck.de

IFRS-Basic course

Schnelle und einfache Bestellung

Sichere Zahlungmethoden

256 Bit Verschlüsselung

IFRS-Basic course

Your perfect start into International Accounting

In this course learn to know and understand the basics of International Accounting (IFRS: International Financial Reporting Standards). We explain you with extended examples, how to prepare a financial statement according to IFRS. At the same time the necessary book entries will be illustrated. Additional you will find out, which further components of a financial statement according to IFRS must be prepared and how the separate accounting transactions take effects to the other components of financial statements (statement of comprehensive income, statement of changes in equity, cash flow statement and notes). On grounds of comparability the appropriate provision according to HGB will be contrasted.

This course prepares for the webbased exam "Certified IFRS-Accountant - basic certificate of DL Accounting and Tax GmbH. The examination board consists of specialists, especially professors. It is a recognized qualification. It is possible to have ECTS credited towards your studies.

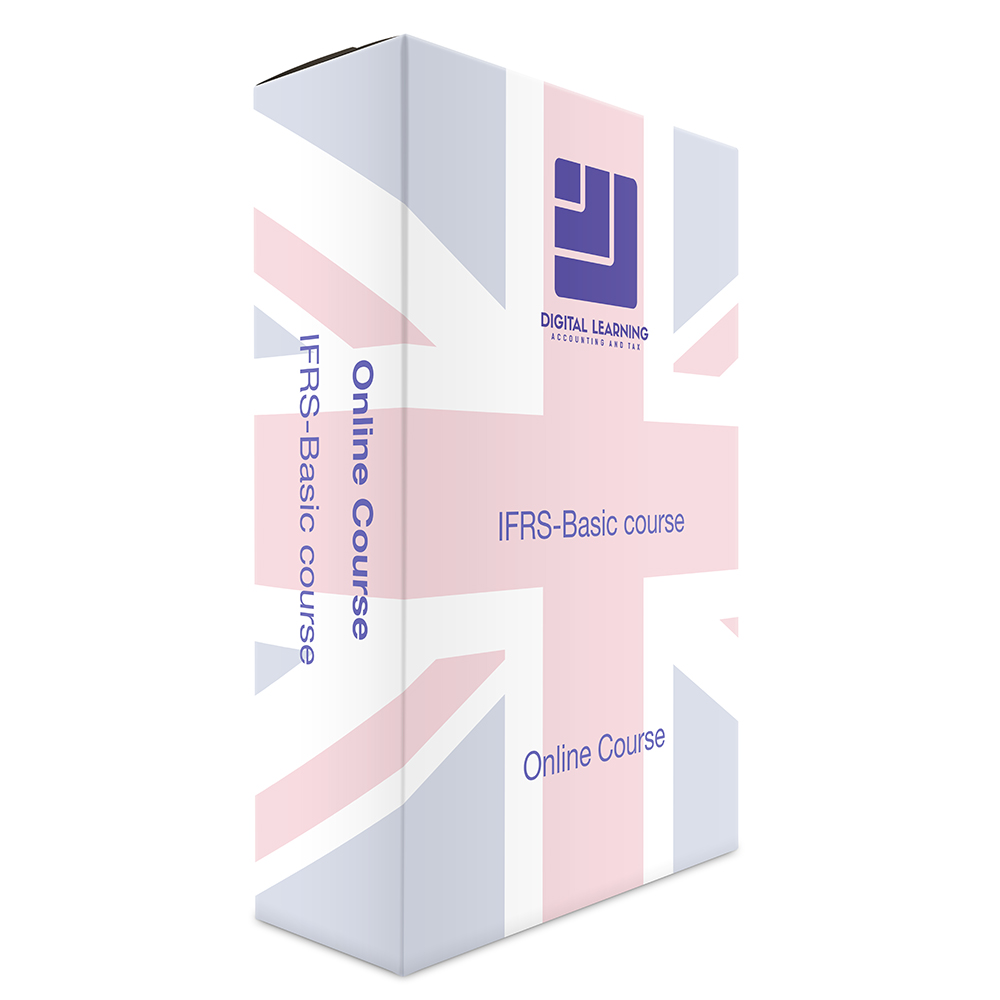

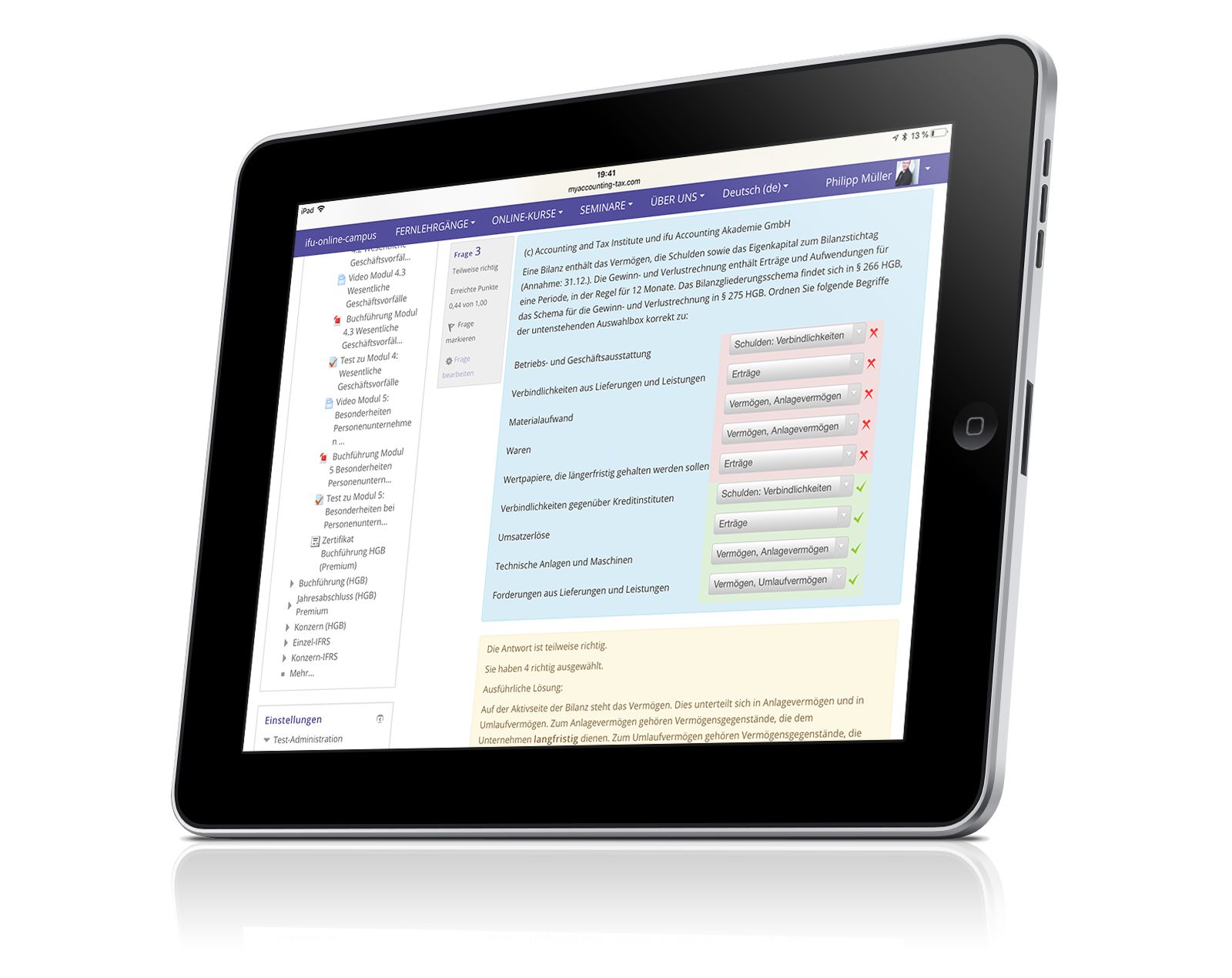

You learn the skills in International Accounting with our units and webbased-trainings. You have an optimal assessment of training success with our webbased-trainings. Learn independent, access to the complete "Accounting know-how", from any place, at all times.

Our efforts

Our approved concept in facts an figers

Lectures

Get 5 tailored lectures (total 176 pages).

Webbased-Trainings

Prove your know-how! Tasks based on exam level will prepare

you well for the exam and practice. Get an access to 156 exercises

with extended illustrations.

Assistance

We support you and answer promptly.

Participant Certificate

In connection with your course booking you will get a significant

participant certificate.

Access Period

The access period comprises eight month.

Webbased-Trainings

Webbased tasks are seperated in units. The solutions comprise extended illustrations and back-ground-knowledge. After the test-termination a percentage evaluation illustrates the achieved results.

The tasks base on the level of University exams or "IHK-exams" and were prepared by experts.

Digital Units

The units can be downloaded as PDF, so you can access from any place, at all times.

Participant certificate

After termination of course you get a significant participant certificate. If the exam for the certified IFRS Accountant-basic certificate is passed, a graded certificate and certificate will be issued.

IFRS-Basic course

Your course content

Unit 1: Basics to international Accounting

Purpose and framework of IFRS-Accounting

Structure of IFRS

Components of financial statements: Financial statement of position, comprehensive income, cash flow statement, statement of changes in equity

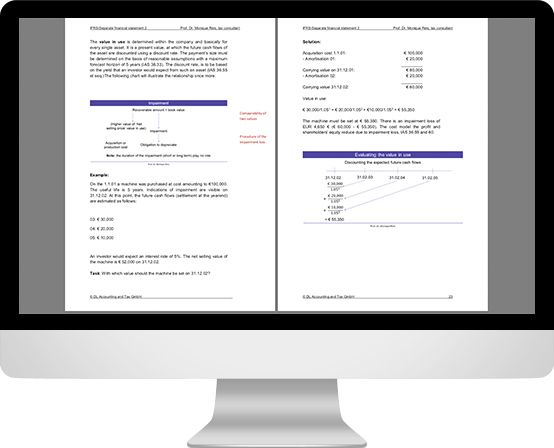

Unit 2: Property Plant and Equipment

Recognition

Initial measurement and subsequent measurment

notes

Unit 3: Intangible assets and financial instruments

Recognition of intangible assets

Initial measurement and subsequent measurement of intangible assets

notes

definition of financial instruments

Categories of financial instruments

Initial and subsequent measurement according to the categories

notes

Unit 4: Inventories

Definition

Initial and subsequent measurement, in particular cost formulas

notes

Unit 5: Liabilities and Equity

Payables: Initial measurement and subsequent measurement

Provisions, accruals: Initial measurement and subsequent measurement

Contingent liabilities (notes)

Equity, in particular classes of equity

Your course on every device

Further education with time and place flexibility

Unsere Referenzen